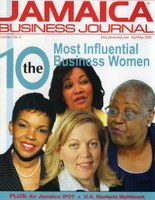

Karen Fitz Ritson featured in the Jamaica Business Journal

“It is better to be the king maker than to be king” was something that Paul always told his little daughter, Karen Fitz Ritson, something she did not fully understand at between ages 6 -8, but understood as she grew older. Fast forward thirty years later and on any given weekday you will find Fitz Ritson, or one of her staff members, standing in front of a classroom filled with corporate executives and aspiring executives. Many of the executives come to Fitz Ritson with MBAs and years of service in the corporate trenches. In the classes you will also find entrepreneurs, doctors, and administrative assistants – the gamut of educated Jamaicans. All aspire to learn from Fitz Ritson – how to manage money and how to be strategic in business.

And with a certificate from her institute – executives, assistants, holders of MBAs, and all the other forms of corporate animals have a tendency to move up in their career. And that is what separates Fitz Ritson & Associates from the myriad of private schools in Jamaica. Her organization boasts a track record where 58% of students are promoted in their respective organizations less than a year of certification. Fitz Ritson is indeed a king maker! “My students call themselves Ritsonites,” she said, “this firm is not just a professional training institution, is now a recognized brand”.

For the past six years, her company has become the institute of choice for financial professionals seeking to advance their careers. Fitz Ritson & Associates has set the industry standard. Some of the milestones this institute boasts in its short history is being the first mover in professional training in the region to train on line (2005) and in 2006 was the first institute in the Caribbean region to offer accredited professional programmes.

On the surface, some would say that Fitz Ritson’s success was somewhat pre destined as the Fitz Ritsons have been on the social register since the 1870s through great grandfather William followed by grandfather Donald a stalwart in the development of Boy’s Town and former Scout Commissioner and former Chairman of Mico Teachers college, this legacy was passed on to father Paul who was famed Chairman of In Sports in the early 1970’s and brought celebrities like George Foreman to Jamaica. However the family name and connections did not insulate them from the harsh realities of life.

In 1974 Paul was tragically murdered at age 31 and left a nation in mourning for many years to come. The controversial Gun Court was quickly erected to help stem the tide of gun crimes in the country. Fitz Ritson recants when in University “we hosted Mike Wallace of the famed 60 Minutes to our campus and in our discussions he shared with me that early in his journalism career he was asked to cover some murders in Jamaica, notably a famed lawyer and I chuckled telling him I was the daughter of that lawyer. We immediately bonded! I remember in his closing address he said to the audience the best part of his visit was meeting me – watch out Jamaica you have a dynamite gal on your hands. The Jamaicans in the audience gave a resounding applause”

To experience such a loss from an early age ensured that Karen became focused but quick to add not hardened “my family has always been a tower of strength to me and I have always basked in the love of my mother (Winsome), grandparents on both sides of the family and my stepfather (Neville)” who suddenly died of a heart attack when Fitz Ritson was aged 15. “My Mom widowed again was a rock for myself and my three year old sister Lisa”

Fitz Ritson steered away from law which the Fitz Ritson’s thought was the natural rights of passage. Instead Karen went to the Florida International University to study Finance and International Business – two unknown fields in Jamaica in the early 1980’s.

Fitz Ritson returned home and she secured a position in the Office of the Finance Director (Peter Moss Solomon) at Grace Kennedy where she learned at the feet of the masters. Although grateful for her training ground at Grace Kennedy, she made a pivotal career choice and left Grace to work at the stock brokerage firm Paul Chen Young and Company Limited (now renamed Stocks and Securities).

The timing would prove to be an important training ground. Fitz Ritson joined PCY at the peak of the 1993 Bull Run. All market signals we not aligned as inflation and interest rates were staggering at 60%. The stock market eventually corrected and many investors got burnt.

In 1994 Fitz Ritson joined the fledging unit trust company Sigma Investment Management Systems Ltd. The company was founded by the Matalon family, long known for their track record of successful business ventures. Fitz Ritson laughs and remembers how people thought Joe Matalon was insane to form this company but Karen said “It was a stroke of genius, Joe hired people with a proven track record and reputation in their respective fields”

Although the Matalons backed the company, the money didn’t come pouring in. “The business of managing money is about trust and performance and knowing what your clients want”. Fitz Ritson recalls, “As a new company you better go out there and beat the pavements”. Sigma did have the advantage of Scotiabank, who provided them with a list of clients “Sigma led me to some very interesting places”, Fitz Ritson explains “One port of call was in Santa Cruz at a go go club as the owner was described to be cash rich. What ever misgivings I had was quickly dispelled when I entered the establishment. I felt that I was in a time warp back in the 1970’s with the strobe lights from Saturday Night Fever and the black and silver wall paper, but a good professional knows how to put their best foot forward and close the business deal.

By the age of 30, Fitz Ritson’s reputation was cemented. She recalls several CEO’s of listed companies inviting her to meet with them to share the knowledge of what was going on in their companies. These relationships were vital as these same CEO’s eventually became guest lecturers in her professional programmes.

During the years 1996 – 1999, the financial sector struggled through the FINSAC era when the financial sector collapsed. It was during this time that she spent a year as investment manager at Crown Eagle, a sister company of PCY. “During that time you had to be a prudent and a focused wartime manager – many persons collapsed under the strain”.

She recalls of a client who came to do an encashment and when advised that he would get his cheque in 48 hours the client pulled a gun at her. “I didn’t panic – I told the client that obviously he was very upset and offered him a cup of tea, my secretary almost fainted when she saw what was happening, but I signaled her not to panic and invited her to come in and make the tea for him. After he calmed down and left – my secretary had an asthma attack. On reflection I was very upset of the decisions of our superiors that could have jeopardized the lives of my staff and me”. Fitz Ritson left Crown Eagle afterwards having delivered the number one balanced fund in the country.”

By 1997 the 31 year old Karen returned back to the familiar stomping ground of Sigma as the Equity and Research Manager. Challenges were always abound as it was now her responsibility to turn around the Equity Portfolio then positioned as the 24th out of the 27 funds in Jamaica. Within two years Fitz Ritson and her team turned around the Fund to number one. This was achieved against a backdrop where treasury bills ranged between 32 – 34% and the JSE index grew 13%. The Equity portfolio in 1999 outperformed all funds with a return of 36%.This fund is now managed by Pan Caribbean and remains the number one fund on the country today. Coupled with that Karen taught Portfolio Management at the Jamaica Institute of Management for their securities course.

Now at the top of her game Karen to take a break. At 33 years old she returned to her alma mater and FIU and pursued her graduate studies. With a MBA in hand, Fitz Ritson went back home to Jamaica but was unsure of what to do with her future as she was not too keen in returning to the corporate jungle.

Her good friend and confidant Errol Green of the Kingston and St. Andrew Corporation fame gently prodded her into starting her own business and consultancy “Karen you are so naïve, do you not recognize the track record and the foundation you have built, leverage on that and start your own business.”

June of 2001, Fitz Ritson & Associates was born. It was her renewed mission to uplift and upgrade the financial landscape and teach people the “mystics of fund/portfolio management”. Her students benefit from her passion in this area because she shares more than the technical skills, but grooms them for being successful professionals in their field. A student who gets a solid recommendation from Fitz Ritson knows that it will open doors for them as she maintains even closer linkages with her colleagues in the industry and enjoy mutual respect. Fitz Ritson started a mentorship programme where she has handpicked a few of her graduates with the blessings of their organizations to further groom them. “We have to earmark successors so you better groom them early”

Known for her forthrightness in speaking out on relevant issues asked of her opinion on leadership she told the Jamaica Observer in April, 2007 “The 21st century leader needs to be a risk taker and in doing so they have to have a sound understanding of the environment they operate in. Today’s leaders need to be courageous and say what they mean and be prepared to accept the consequences, they have to be creative thinkers to keep ahead of the pack and be flexible.” Fitz Ritson then spoke about how she defines success. “Successful companies today are not necessarily the biggest companies today and the mega conglomerates. Successful companies are those that go out there and understand the needs of their clients and continuously work at providing those needs in a timely, affordable and customer centric fashion.”